Little Known Questions About Mileagewise - Reconstructing Mileage Logs.

Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

Table of ContentsThe Mileagewise - Reconstructing Mileage Logs DiariesThe smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking AboutThe Of Mileagewise - Reconstructing Mileage LogsThings about Mileagewise - Reconstructing Mileage LogsSome Known Facts About Mileagewise - Reconstructing Mileage Logs.Excitement About Mileagewise - Reconstructing Mileage LogsThe 7-Second Trick For Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Range attribute suggests the quickest driving path to your workers' destination. This function enhances performance and contributes to set you back savings, making it an essential asset for services with a mobile workforce. Timeero's Suggested Route attribute further enhances responsibility and efficiency. Staff members can contrast the recommended path with the real course taken.Such a method to reporting and conformity streamlines the typically intricate job of handling mileage costs. There are lots of benefits associated with utilizing Timeero to maintain track of gas mileage.

The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

These added verification measures will certainly maintain the Internal revenue service from having a factor to object your mileage documents. With precise mileage monitoring innovation, your staff members do not have to make harsh mileage estimates or also stress regarding mileage expense tracking.

If a staff member drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all vehicle expenses (free mileage tracker app). You will require to continue tracking gas mileage for work even if you're making use of the actual cost technique. Maintaining mileage documents is the only means to separate company and personal miles and offer the evidence to the internal revenue service

The majority of mileage trackers allow you log your trips manually while determining the distance and repayment amounts for you. Lots of likewise featured real-time journey monitoring - you require to start the application at the beginning of your journey and stop it when you reach your last destination. These apps log your beginning and end addresses, and time stamps, in addition to the complete distance and reimbursement amount.

Mileagewise - Reconstructing Mileage Logs - Questions

This consists of costs such as gas, upkeep, insurance, and the lorry's devaluation. For these expenses to be thought about deductible, the car must be made use of for service objectives.

Rumored Buzz on Mileagewise - Reconstructing Mileage Logs

In in between, vigilantly track all your business journeys keeping in mind down the starting and ending readings. For each journey, record the place and service purpose.

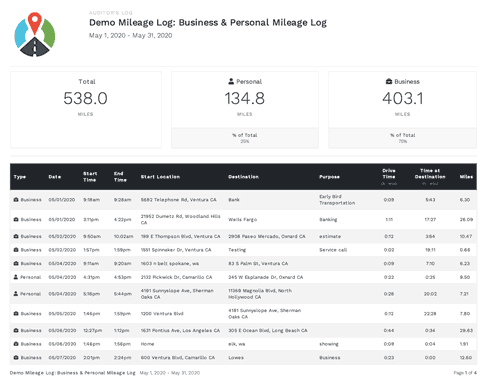

This consists of the total company mileage and complete mileage build-up for the year (organization + individual), trip's day, destination, and objective. It's important to tape activities quickly and keep a coeval driving log outlining date, miles driven, and company purpose. Right here's just how you can improve record-keeping for audit objectives: Start with making sure a precise gas mileage log for all business-related travel.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

The real expenditures method is an alternate to the basic gas mileage price technique. Rather than calculating your reduction based on an established price per mile, the real expenditures approach enables you to subtract the real expenses related to using your vehicle for organization objectives - mile tracker app. These prices include fuel, maintenance, repairs, insurance, depreciation, and various other related expenditures

Those with significant vehicle-related expenses or one-of-a-kind problems may benefit from the real expenses technique. Inevitably, your chosen technique should line up with your specific monetary objectives and tax obligation situation.

Unknown Facts About Mileagewise - Reconstructing Mileage Logs

(https://low-magpie-373.notion.site/The-Best-Mileage-Tracker-for-Effortless-Tax-Season-Prep-145f5d33a31580328873c64a3742e348)Calculate your complete organization miles by using your beginning and end odometer readings, and your recorded company miles. Precisely tracking your specific mileage for organization trips aids in confirming your tax obligation deduction, particularly if you opt for the Requirement Gas mileage approach.

Keeping an eye on your mileage manually can require persistance, however remember, it can save you cash on your see it here tax obligations. Follow these actions: Document the date of each drive. Tape-record the overall gas mileage driven. Think about noting your odometer readings prior to and after each journey. Take down the starting and ending factors for your journey.

The Facts About Mileagewise - Reconstructing Mileage Logs Uncovered

And currently almost everybody utilizes GPS to obtain about. That indicates nearly everyone can be tracked as they go regarding their organization.